Reducing greenhouse gas (GHG) emissions and transitioning to a decarbonized economy is the defining issue of our time. Despite the many pledges from countries and companies, without significant policy changes and technological breakthroughs, we are projected to fall short of what is required to meet the Paris Agreement by 2050 and limit the rise in global temperatures to 1.5 ℃ above the pre-industrial era. (EIA, 2021) The emission reduction pledges for 2030 need to be seven times higher to align with the Paris agreement’s goal. Currently, there is a huge gap between aspirations and reality with potentially devastating consequences. (UNFCCC, 2022)

By 2050, the planet’s population is expected to reach nine billion, with power consumption expected to triple as electrification and living standards grow. The race to achieve “net zero” emissions will accelerate new waves of innovation and create the largest reallocation of capital in history. (RBC Capital Markets, 2022) As the world transitions, PLM will play a critical role in the many innovations that will be occurring as well as in ongoing sustainable operations.

The world requires more energy, which accounts for over 70% of GHG emissions, and, more specifically, electric power, which is affordable, dependable, consistent, and easily accessible while still meeting the “net zero emission targets. But can we afford it?

Oil and natural gas prices rose in 2021 as we rebounded from the shutdown. Russia’s invasion of Ukraine resulted in an energy crisis. This is a separate topic, but being dependent on Vladimir Putin for cheap oil, natural gas, and coal imports has proven to be a poor policy as energy security is concerned. In the short term, this negatively impacts plans to get to “net zero,” but long term, this should motivate Europe and the world to accelerate their efforts to transition away from fossil fuels.

Let’s review some key factors about our energy mix and its economic viability. Today, around 80% of our global energy comes from fossil fuels. By 2050, fossil fuels are projected to make up 43% of global energy demand. (McKinsey 2022) When fossil fuel demands will peak depends on whose projections you believe. However, what is consistent is the decrease in fossil fuels based on the projected growth in renewable energy. The real issue is the time it takes to build out renewable sources and a smarter, more flexible, and more distributed grid.

But the wind doesn’t always blow, and the sun doesn’t always shine, so how do we get a consistent minimum baseload power (24 hours per day) from renewable energy at a reasonable price?

Traditional Baseload

The term “baseload” was first used when the electric grid was originally built over one hundred years ago. Baseload power traditionally comes from power plants that operate at roughly 70 to 90 percent of their capacity and can supply the minimum baseload power 24 hours a day. They only shut down for maintenance. Historically, baseload power came from coal, nuclear, and combined-cycle natural gas power plants. Geothermal and hydro (run-of-the-river) are also used for baseload; however, both are geographically constrained.

In the baseload model, additional “load-following” or “intermediate” plants operate in response to changing demand and run around 30 to 50 percent capacity. They either shut down or curtail their output during off hours, such as at night. Historically, this is addressed by either simple cycle gas turbine units, which can be shut down daily if required, some older coal plants, or combined cycle natural gas plants. A combined cycle powerplant recycles the exhaust, versus a simple cycle gas turbine unit that propels hot gas through a single turbine and does not recycle the exhaust.

To avoid blackouts, P&Us will run “peaking units” when demand reaches peak levels, such as on a hot summer day when many people are using air conditioning. Simple cycle gas turbine units typically address this. Gas turbines primarily use natural gas but can use many fuels, including fuel oil and diesel.

Traditionally, the grid delivers the power from a smaller number of generating facilities mentioned above that are located relatively close to the consumer. These sources distribute electricity over a complex patchwork of public and private grids using high-voltage transmission lines, substations, transformers, and local grids to provide lower voltages to our homes and businesses. This is a top-down or one-way distribution model.

Baseload Model Fallacy

Solar and wind are intermittent. Previously, you couldn’t store or deliver it on demand. However, the baseload model that I described above is pre-renewables. It is based on having fuel in place, so when demand is needed, P&U companies deliver it over a dumb one-way grid, similar in principle to the pipes that deliver water in your home.

Where you have a large amount of renewable energy, the model can be flipped from a centralized model to a more decentralized one, where a smarter, more flexible grid allows operators to adjust their output to meet demand. This will still require natural gas power plants for backup or “intermediate” use, but the peaks won’t be as severe because the grid is becoming more flexible in terms of distribution. Coal and nuclear plants generally run at a steady level, whereas natural gas-fired plants can be dialed up and down, which is important if we’re going to achieve enough electricity from renewable forms of energy.

Smart Grid

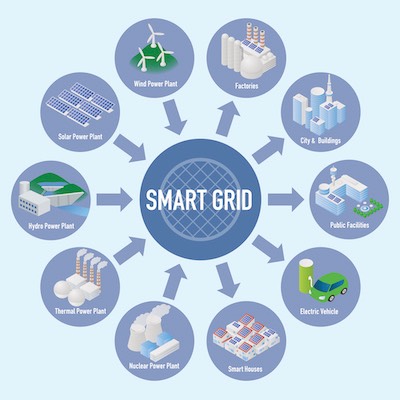

The grid and storage are the key to the green transition in the power industry. The existing grid is vulnerable to extreme weather events and cyber-attacks, with power outages costing U.S. businesses around $150 billion annually. (Marsh McLennan, 2022) It also suffers from a lack of efficiency. According to the EIA, in the U.S., about 5% of the energy is lost in transmission, worth about $6 billion to the consumer. The smart grid is the key to enabling lower-cost energy to be used when required. It is based on the premise that the amount of electricity generated for each instance must equal the consumption across the grid. Smart Grid technologies enable grid operators to see and manage electricity consumption in real-time. This greater insight enables the P&U to use renewable energy sources when applicable, resulting in greater control, reduced outages, and a lower need for peak power. This doesn’t eliminate the need for nuclear or gas turbines, but especially with gas turbines, it provides greater flexibility. Overall, the smart grid distributes power better, provides greater flexibility, better energy security, lower costs, and dramatic reductions in GHG emissions.

The smart grid enables two-way communication between the consumer and the P&U to deliver the correct amount of energy as required. In this way, the consumer will be able to sell power back to the P&U. If you think this is far-fetched, I know people and businesses that have been doing this since the early 1980s, but now with more flexible low-cost solar, it will become more commonplace because an increasing number of people are starting to generate power off the grid already.

Consumers are also transitioning to using smart appliances, which leads to the smart home that uses smart meters and a home area network (HAN) that can control what and when we use electricity. The HAN can be used to charge EVs and other household appliances, resulting in less demand during peak times, lower utility bills, and greater visibility across the grid.

Renewable Energy is Less Expensive

Why go to the expense of creating a more flexible, robust grid? The answer is that solar, wind, and hydro are the least expensive forms of power. Solar and onshore wind will continue to be more economically viable due to the low cost of production and operation, as well as innovations enabling longer lifespans and, in some cases, improved recycling and reuse.

Even in China, India, and the U.S., the three largest coal consumers, coal demand will continue to drop because the cost of retrofitting a coal plant is already not cost-competitive with a new solar or wind farm for the same energy capacity. By comparison, the most modern coal plant is roughly twice the cost of solar or onshore wind as measured in megawatts per hour (MWh).

China, the world’s leading polluter, may not begin reducing coal until 2026, but it is investing heavily in renewable energy to the tune of $380 billion in 2021. India has the fastest-growing rate of renewable electricity of any major economy.

Power &Utilities (P&Us) are investing in solar and wind. They are also trying to sell off fossil fuel generation assets and shifting their focus to renewables, nuclear, hydrogen, electricity networks, and energy services, including energy storage. (Power and Utilities Transactions and Trends, Ernst & Young 2021)

Since solar and wind are intermittent, P&Us are also investing heavily in decentralized, more resilient, smarter energy grid technology and storage that can store and use renewable energy when required. They are investing in Battery Energy Storage Systems (BESS), thermal storage, which can include compressed air energy storage (CAES), mechanical storage, pumped hydro (the most commonly used today), and green hydrogen, which involves converting electricity via electrolysis to a liquid form to be stored or moved. All the storage technologies are undergoing innovation to improve efficiencies, lower costs, and increase scale. The global energy storage market is expected to attract approximately $1 trillion in new investments over the next decade, with costs declining by a third over that period.

The Challenge

There will be many technical hurdles to overcome, but the real issues are time and political willpower. Will the grid change quickly enough to meet the 2050 goals of “net zero?” I have my doubts, but it has nothing to do with cost. Every country is balancing short-term realities, such as what is happening in Europe right now, which impacts us all. But of deeper concern are special interests trying to cling to the past. Brazil, for example, consumes over half its energy from renewable generation. Still, this year, due to an upcoming election, their president decided to continue subsidizing their dying coal industry at much higher than market prices through 2040. This move only benefits one state―Santa Catarina―in return for votes.

The good news is there are thousands of projects underway to transform the grid to a smarter, more distributed grid known as “smart grid 2.0.” This will take advantage of new technologies such as 5G networks, AI/ML predictive analytics, digital twins, and IoT, thus enabling the grid to pivot to support a greener, decarbonized economy.

Costs

The U.S. has passed legislation and committed to a net-zero electricity grid by 2035. With this, there could be a 31-44% reduction in emissions by 2030 (Bipartisanpolicy.org, 2022) and a flood of private investments in cleaner and more renewable energy, which, in the end, will cost less, not more.

Overall, the costs to meet the 2050 target of net zero has had many projections ranging from $10 to $90 trillion dollars. I struggle with that, in general, it appears that those who invest in going green are making great investments in the future. Not unlike early investments in the internet. Many large banks, investors, and private equity firms are investing in Green Energy because it’s a great way to make money. For example, the world’s largest asset manager, BlackRock, with approximately US$10 trillion in assets under management, is fully committed to decarbonizing its portfolio. Their CEO, Larry Fink, believes that “Every company and every industry will be transformed by the transition to a net zero world. The question is, will you lead or be led…Engineers and scientists are working around the clock on how to decarbonize cement, steel, plastics; shipping, trucking, and aviation; agriculture, energy, and construction. I believe the decarbonizing of our global economy is going to create the greatest investment opportunity of our lifetime.” (BlackRock Larry Fink CEO Letter 2022) Do you really want to bet on coal?

To me, that’s like betting on Blockbuster. All the major energy OEMs are making serious shifts to green energy, which would not make sense unless it was profitable. They either adapt or die.

The faster we transition to clean energy, the less expensive it will be. Green energy technology costs have been falling over the past decade with dramatic increases in use and innovation. It’s possible that transitioning to a decarbonized energy system by approximately 2050 could save the world $12 trillion. (University of Oxford, 2022) Today renewable energy is really the only energy source that can provide long-term price stability―and in today’s inflationary environment, that is what every business and consumer wants. (The Wall Street Journal, 2022)

The cost to the economy by not investing in a decarbonized world, I believe, would be incalculable.

Let me know what you think!

Mark

PS: Check out the new Green Energy consulting practice page!