Key takeaways:

- Healthcare costs in the United States are growing faster than GDP, a trend that demands systemic change.

- Technologies and trends in the consumer market, like smart, connected products, show great promise to deliver better healthcare outcomes at lower cost.

- Strong product lifecycle management (PLM) processes and enabling solutions are essential to develop and manufacture smart, connected products and new drug innovations.

- Accenture life sciences capabilities and enabling technologies are helping leading life sciences companies meet their growth and innovation objectives.

Introduction

According to the U.S. Department of Health and Human Services (HHS), national healthcare spending is projected to grow at an average of 5.5% per year for 2017-2026.1 This is lower than the 7.3% growth rate prior to the recession (1990-2007), but higher than the average rate since, 4.2%. More importantly, U.S. healthcare costs are rising faster than GDP, which will make it more difficult to pay for these increases. Unfortunately, this high growth has not resulted in improved patient outcomes. The aging U.S. population is also a contributing factor. Older Americans consume healthcare at a much higher rate, and a significantly higher cost, at the end of their lives.

To meet these challenges, the healthcare industry is being disrupted from top to bottom. The same trends influencing the consumer and business market are having an impact on the present and future of healthcare. Social, mobile, analytics, cloud, and the IoT are revolutionizing product markets, seemingly making just about everything we consume smart and connected. Those same capabilities are increasingly being applied to healthcare. Just as consumerization of IT is hitting the enterprise IT organization, the consumerization of healthcare shows great promise to make the user experience―in this case the users are healthcare consumers―more satisfying and successful.

Technology is one way to make this happen. Advances in genetic sequencing and therapies are making individualized treatments practical. While these treatments may be expensive, some initial positive results suggest their efficacy can be worth it. Scanning technologies allow for non-invasive study of the body and the creation of personalized treatments, surgeries, and implants using additive manufacturing. Smart, connected products are everywhere in the consumer market and now help monitor patients inside and out. Wearable technologies combine biometric tracking with GPS and other environmental data to help enhance performance. People can be monitored from the inside by ingesting digital pills to track prescription consumption and be fitted with tooth-based monitors to track what patients eat.

Smart, connected products generate large volumes of data and are raising privacy and security concerns in the public sphere, concerns that multiply with close tracking of personal health data. Any new processes or applications must comply with Health Insurance Portability and Accountability Act (HIPAA) privacy and security regulations.2 This can make things complex, as innovations often seek to reduce inefficiencies caused by data and process siloes. Individual applications must protect their data while also increasing the ways that they might share it. Some say that data is the new oil, and data lubricates the wheels of machine learning that can help deliver new and improved outcomes. The enterprise software market has witnessed the increasing platformization of information technology, a trend where companies rely on development platforms to better orchestrate different layers of their business. This systemic approach can offer significant benefits in healthcare where islands of information must be systematically linked.

Taking a Systemic Approach

The history of innovation and technology development is littered with many cases of doing things because we can, not because we should. There are some good examples from the wearables market. Google Glass came to market prematurely and faded away, partly because of both a poor user experience and privacy issues. The ubiquitous smartphone has put fitness and health applications in our pockets. But just because we can make something smart and connected, do consumers really want someone monitoring their every bodily function? These are point solutions that may be helpful at times but may not contribute to broad-based advancement. To help reduce costs and improve outcomes any new technologies must be considered in light of how they will be used and how they will impact the whole system of healthcare.

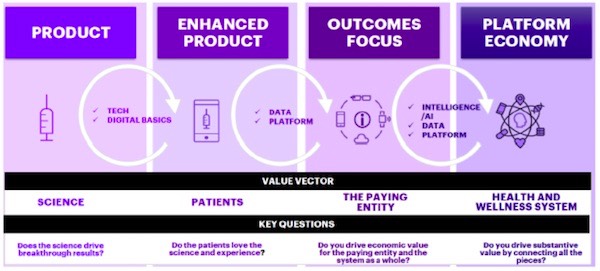

The healthcare system spans the lifecycle of innovations, from science to delivery as part of a health and wellness system. The U.S. system has the added complication of how those outcomes are achieved and who is paying. Figure 1 depicts a systemic view of one healthcare future. New products, like drugs, diagnostic tests and instruments, and other innovations must be weighed against how they will deliver better results. Do they work better for patients? Are they worth it to the hospital, insurer, or other paying entity? These innovations also need to contribute to next-generation health and wellness platforms that can leverage these new technologies and the data they provide to help make better decisions for the system as a whole.

Figure 1―A Systemic View of a Healthcare Future

Accenture Life Sciences

Accenture (NYSE: ACN) is one of the world’s largest strategic consulting and systems integration organizations, with revenues of US$34.9 billion for fiscal 2017. Its 449,000 employees work in more than 200 cities in 53 countries. Over the last several years the company has seen both strong organic growth and market expansion through a series of acquisitions. One significant growth engine is Accenture’s Industry X.0 unit which focuses on the digital reinvention of industry, applying digital technologies to help companies in a range of industries transform their core operations. Responding to today’s interest in digitalization and digital transformation at product companies requires a strong PLM foundation.

Accenture has a 25+ year history in the PLM space, partnering with many leading PLM solution providers, and is bringing this experience, and more, to bear in the life sciences industry in an agile way. Their broad portfolio of capabilities is highlighted in Figure 2.

Figure 2―Accenture's Products Industry X.0 Life Sciences Capabilities

In the “develop & engineer” space, Accenture offers services to enhance their client’s abilities to design and develop smart, connected products, including software and product engineering, and to transform their PLM strategies to seamlessly include application lifecycle management (ALM) processes and tools. Their support continues into manufacturing, offering manufacturing operations management services focusing on manufacturing process excellence by leveraging key manufacturing technologies and solutions, such as manufacturing execution systems (MES). Their manufacturing services also include the application of advanced technology, like wearables and augmented reality, and leveraging analytics to optimize asset utilization. In addition, product quality is an important focus, bringing support for product change control, production planning and scheduling, and reliability and quality management, with a heavy emphasis on continuous improvement. Finally, Accenture delivers these innovative solutions by using new ways of working. They leverage tools and assets to drive design thinking, data analytics, and agile methods which allows for better business outcomes.

Product development and manufacturing organizations rely on a heterogeneous set of tools and technologies. To best meet companies where they are, Accenture has built an impressive set of PLM alliance partners including Aras, Dassault Systèmes, Oracle, PTC, SAP, and Siemens PLM Software. While life sciences companies may use the traditional design, analysis, and collaboration tools offered by the PLM solution providers, their needs also include support for the laboratory and process manufacturing. Specifically, new drug innovations require an integrated “lab to launch” ecosystem including laboratory information management (LIMS), formulation and recipe development, specification management, regulatory lifecycle management and change control technologies. Other Accenture partners include Core Infomatics, Agilent Technologies, GenoLogics, Sapio Sciences, Geno Logics, LabWare, IDBS, and many others. According to Mr. Tom Hartmann, Accenture Managing Director, IX.0 Life Sciences: “Having a holistic vision of product data flow is critical to achieving improved time-to-market, product quality and patient outcomes.”

Customers are already seeing the benefits. A leading global medical device company faced issues typical of many industrial firms. They did not lack PLM strategies and enabling solutions. Having grown through acquisition they had six different systems with disparate processes and disconnected data. The PLM solutions were highly customized and some of the software and hardware was no longer supported by the respective providers. Accenture worked with company leaders to develop a PLM transformation framework supported by a global roadmap to get to one global PLM solution in three releases spanning two years. The Program Management Office, created and staffed by Accenture, drove the implementation, including functional design, data migration, and application development and testing. The flexible data model created for the customer will help streamline assimilating future acquisitions. This new platform now supports over 20,000 global users. The customer estimates their total cost of ownership will decrease by 50% over the next ten years. In addition, they are saving $27 million per year in process efficiency savings.

The pharmaceutical and biotechnology industry is also ripe for disruption. A leading pharmaceutical company was faced with drug patent expirations and competition from generic drugs, a common problem in this global industry. Their fragmented and manual processes, data, and systems were not up to the challenges they faced in both product development and manufacturing and an increasingly demanding regulatory environment. Accenture is helping the company transform their PLM processes from ideation through to drug retirement. Their new solution, built using SAP S/4HANA, will span R&D, regulatory, quality, manufacturing, product change execution, and supply chain planning and logistics. While the implementation is on-going, users can already see the benefits of full traceability across the lifecycle, integrating product specifications and drug formulation/recipe changes, and putting “where used,” “where tested,” and “where sourced” information a few clicks away. While this capability may be well-known to discrete manufacturers savvy to PLM processes and PLM-enabling cross-functional solutions, it can be a revelation in industries like pharma, where document-centric processes and functional siloes make such things difficult. This is a good example of how life sciences customers can benefit from Accenture’s strong combination of strategic consulting and practical, boots on the ground, skills in a range of PLM processes and enabling solutions.

Conclusion

Healthcare is undergoing dramatic systemic change, in part influenced by the technologies and trends affecting society at large. Smart, connected products working as part of socially-aware systems are a big part of those changes. Companies developing such products need strong, well developed PLM strategies and enabling solutions that span mechanical, electrical/electronic, and software development requirements that can meet the strict manufacturing needs in these key markets. In addition, getting new and existing medical innovations and drugs to market faster is essential to growth. PLM processes and enabling solutions are helping life sciences companies streamline product commercialization and manufacturing, ensuring compliance with a wide range of global standards and regulations, potentially enhancing product safety for millions of patients. Accenture, one of the world’s leading strategic consulting firms, has a deep understanding of these systemic changes, and Accenture Life Sciences can bring that knowledge to bear alongside their traditional strengths in PLM and manufacturing. The examples included in this Commentary represent just two of their global successes but are typical of the issues faced by global life sciences firms. Accenture Life Sciences’ ability to provide expert strategic guidance in the boardroom and then elaborate and extend those strategies across the value chain gives their clients and Accenture a significant competitive advantage.